Introduction to SIIP

The main purpose of the SDG Impact Investment Platform or SIIP is to engage international and local investors to help bridge the gap between

- impact requirements aligned to the SDGs (UNIDO journey),

- SME technical and financial needs (SME journey),

- and the investment criteria of local and international impact investors (investor journey).

The SIIP shall be presented by its demonstrator version. It´s final version shall be implemented in 2020.

Let´s follow the investor journey, coming from investor´s profile, creating a pipeline of investible SMEs, selecting a short list of concrete investment targets, and, after an appropriate financial analysis and due diligence, investing in some or all of them in order to design a portfolio in line with the own profile and investment criteria.

This investor journey constitutes the menu of the SIIP app.

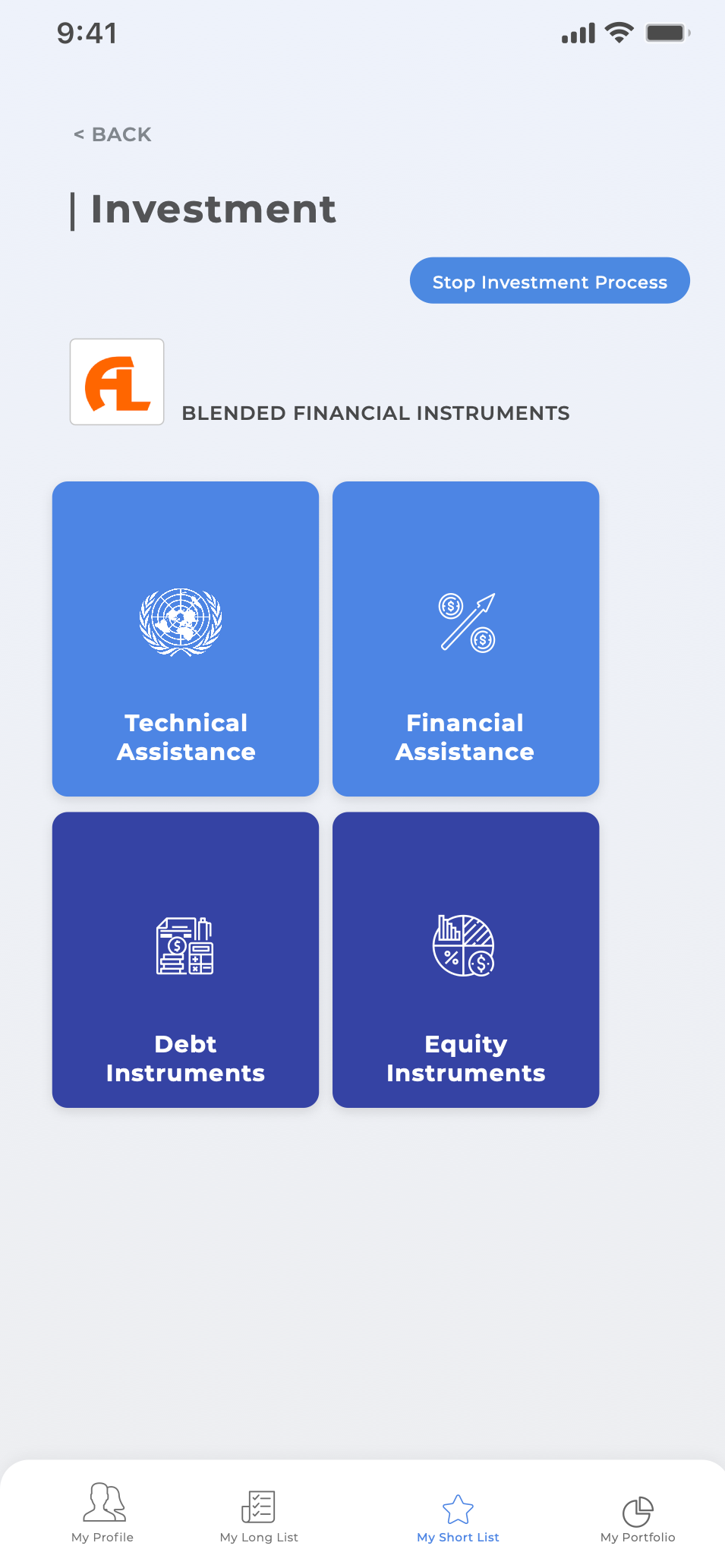

Investment Profile

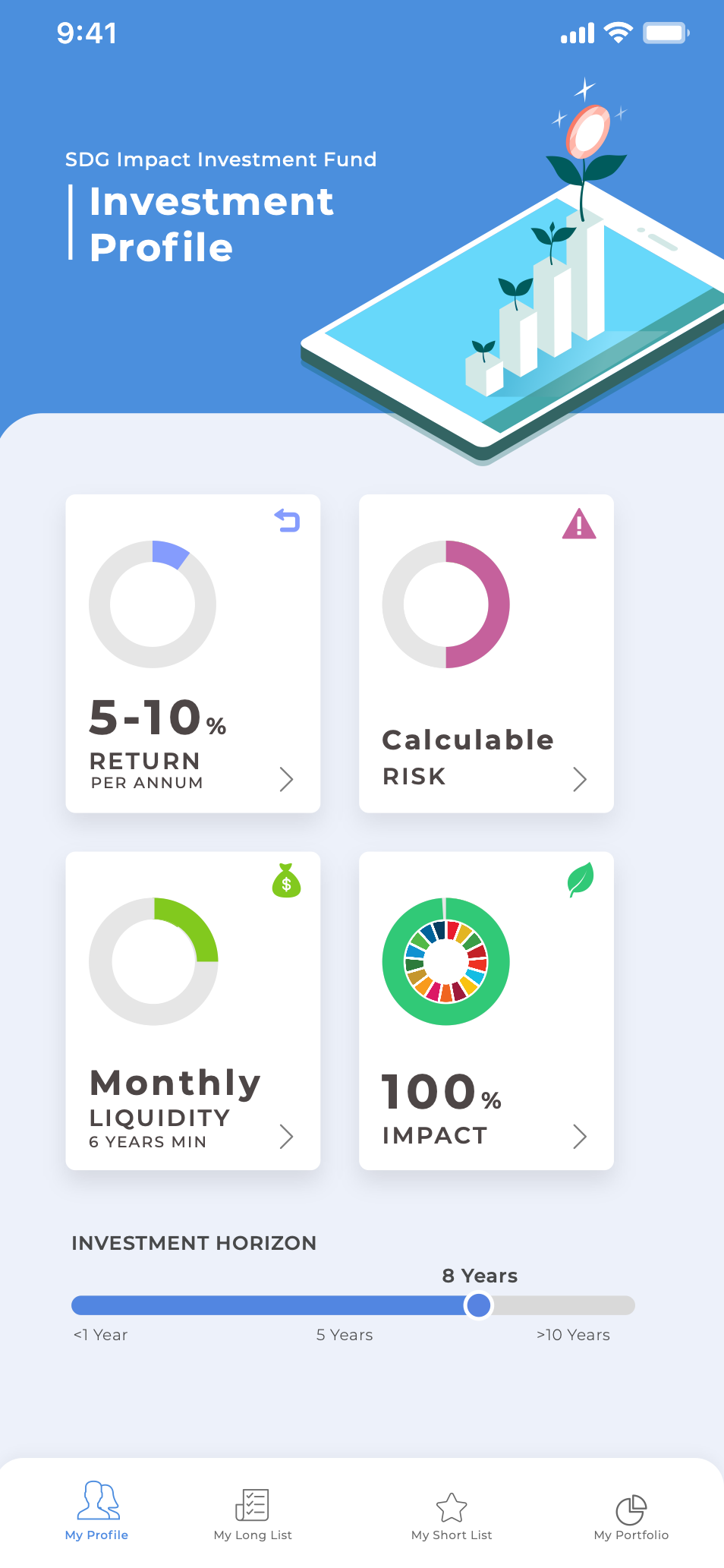

Let´s look at the profile and investment criteria of a certain investor, here the SDG Impact Investment Fund (which does not exist until now but it could also be an existing investor such as a pension fund, an insurance company, a family office, a foundation, or an individual investor).

Each investment is based on a set of investment criteria. The most important criteria are

- expected return (here 5-10 % p.a.),

- accepted risk level,

- planned impact level (here the investor has a 100% approach which means all of her investments should achieve a certain impact level aligned to one or some of the 17 SDGs), and the

- investment horizon or period,

It´s common knowledge that there are interdependences between these three criteria: for example, the higher the expected return, the higher the risk.

In fact, there are many other criteria such as preferred regions of investment, types of investment (equity or debt), and so on.

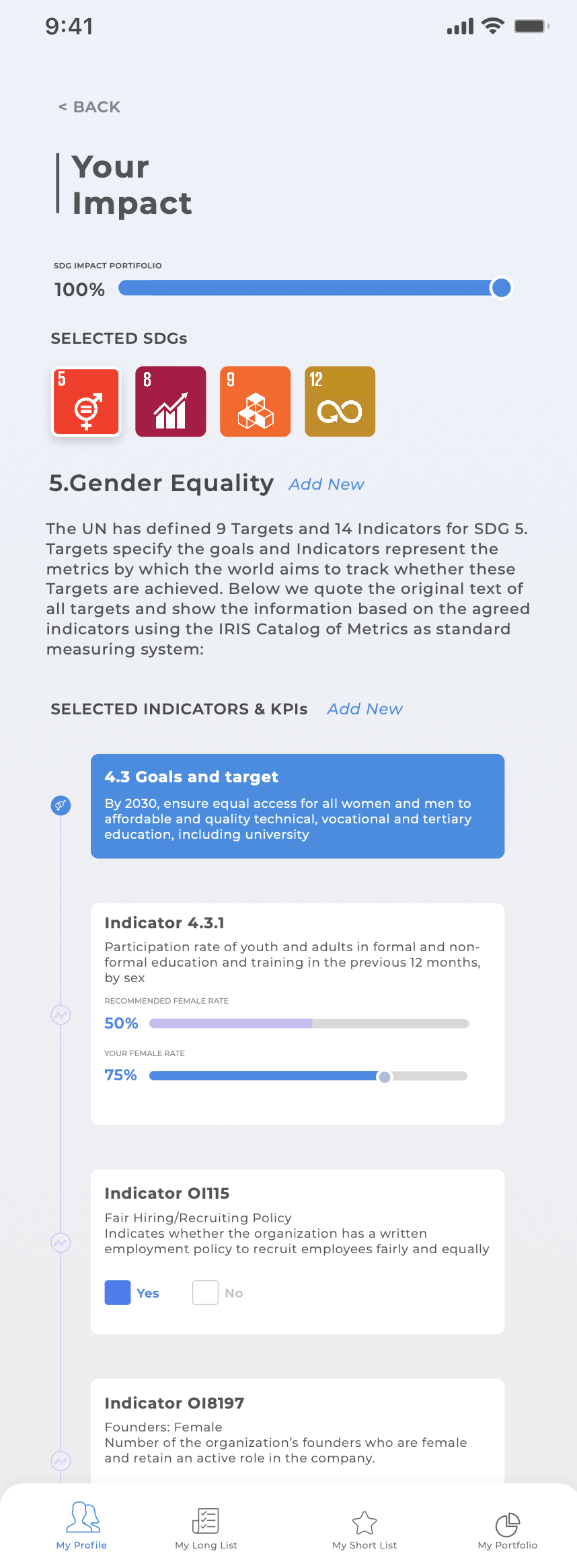

Let´s have a closer look at the impact criteria of our investor:

Your Impact

As already stated, this investor follows a 100% impact approach which means all investments should achieve a certain impact level.

The investor may choose one or more SDGs together with appropriate targets and indicators. It´s the task of UNIDO to measure the selected SDGs and to certificate a Proof of Achievement (PoA).

In this example the investor aims at

- SDG 5: Gender equality,

- SDG 8: Decent work and economic growth,

- SDG 9: Industry, innovation, and infrastructure, and

- SDG 12: Responsible production.

The SIIP will not only give all information on the SDGs, targets, and indicators but will also offer the most important and widely accepted measurement systems such as Theory of Change, IRIS or TONIIC.

Investors will choose the appropriate KPIs in accordance with their investment criteria.

After the investor´s decision concerning expected impact, return, risk, investment period, and others, the SIIP database - with in future tens of thousands of SMEs - will offer a long list of SMEs which exactly are matching these investment criteria.

This pipeline of SMEs and the experience to work with them since more than 50 years, this is UNIDO´s first so-called „Unfair Advantage“, a competitive advantage that cannot be copied easily.

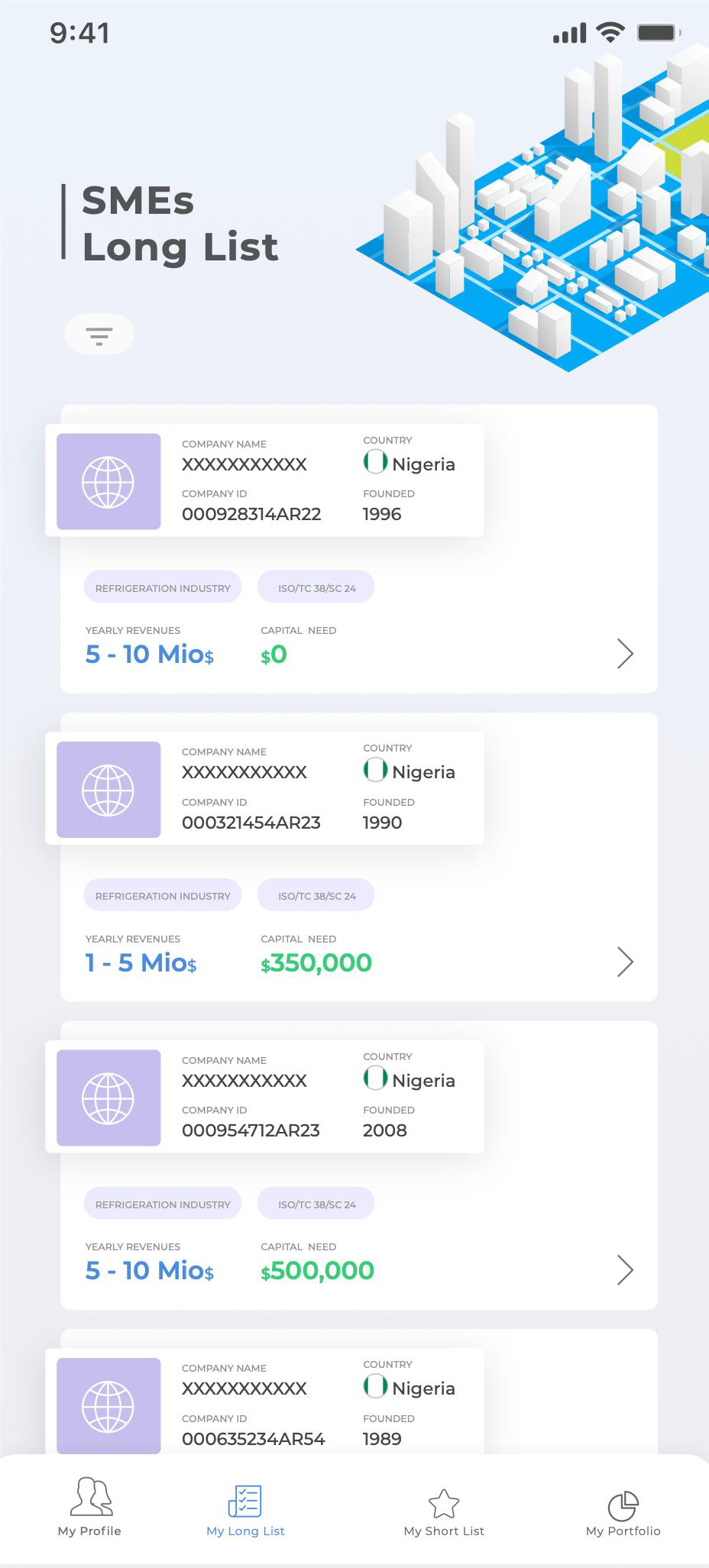

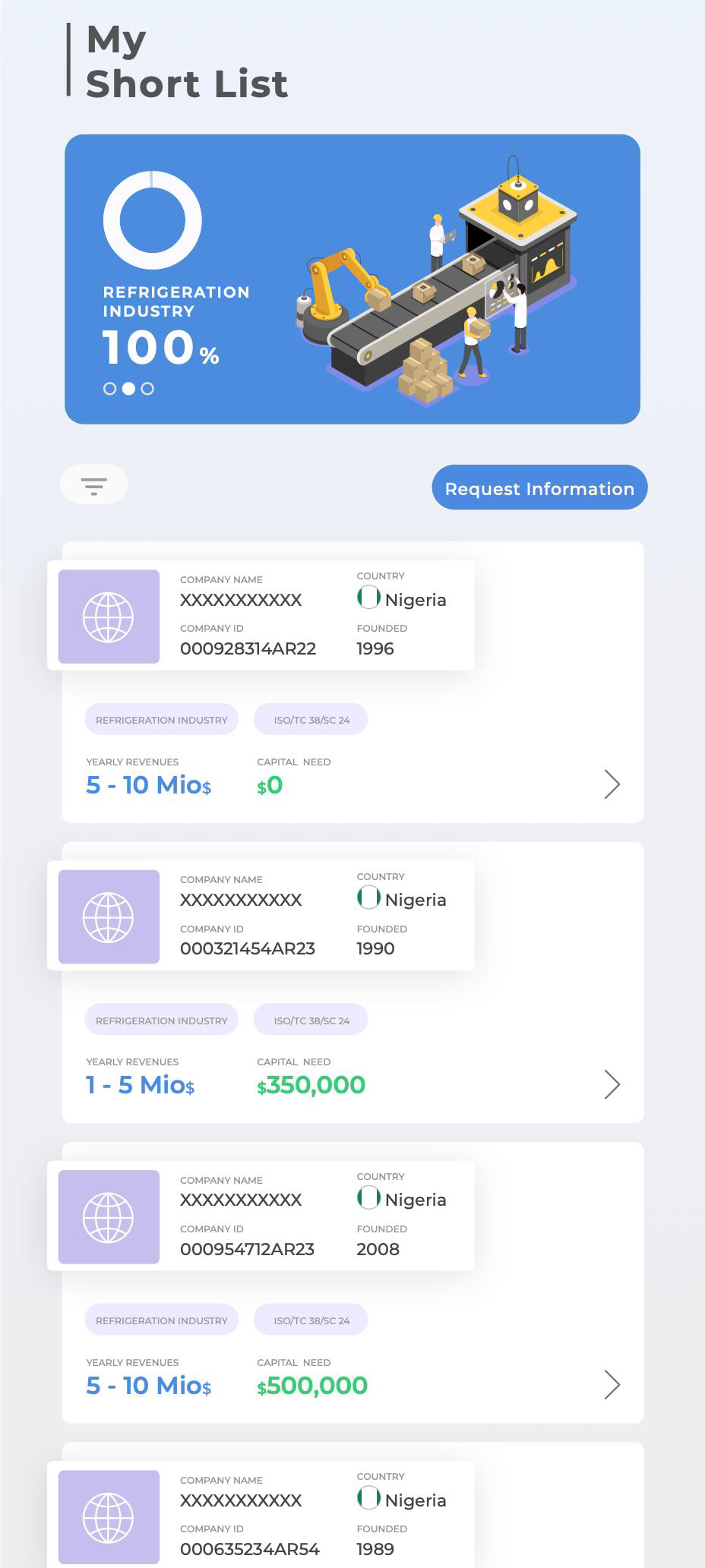

SMEs Long List

The SMEs Long List, initially in an anonymised way, will present some key information about the SME such as

- unique ID number provided by SIIP, by which the SME can be identified by the investor without knowing the real identity at this time,

- home country,

- founding year,

- revenue range, and

- capital needs.

It´s up to the investor to define the information she needs. While investors should be aware that in this stage not all information will be available in details, SMEs should know that the probability to be funded grows with increasing information density.

In this example the first SME does not specify a certain capital need.

The size of the list depends on the investment criteria. For example, if the investor determines the highest level of expected return and the lowest risk level simultaneously, it´s no question that the list will be rather short than long if not empty at all.

Let´s assume the investor is interested in the third SME in the list because it has a higher revenue range of $ 5-10M and a capital need of $ 500K.

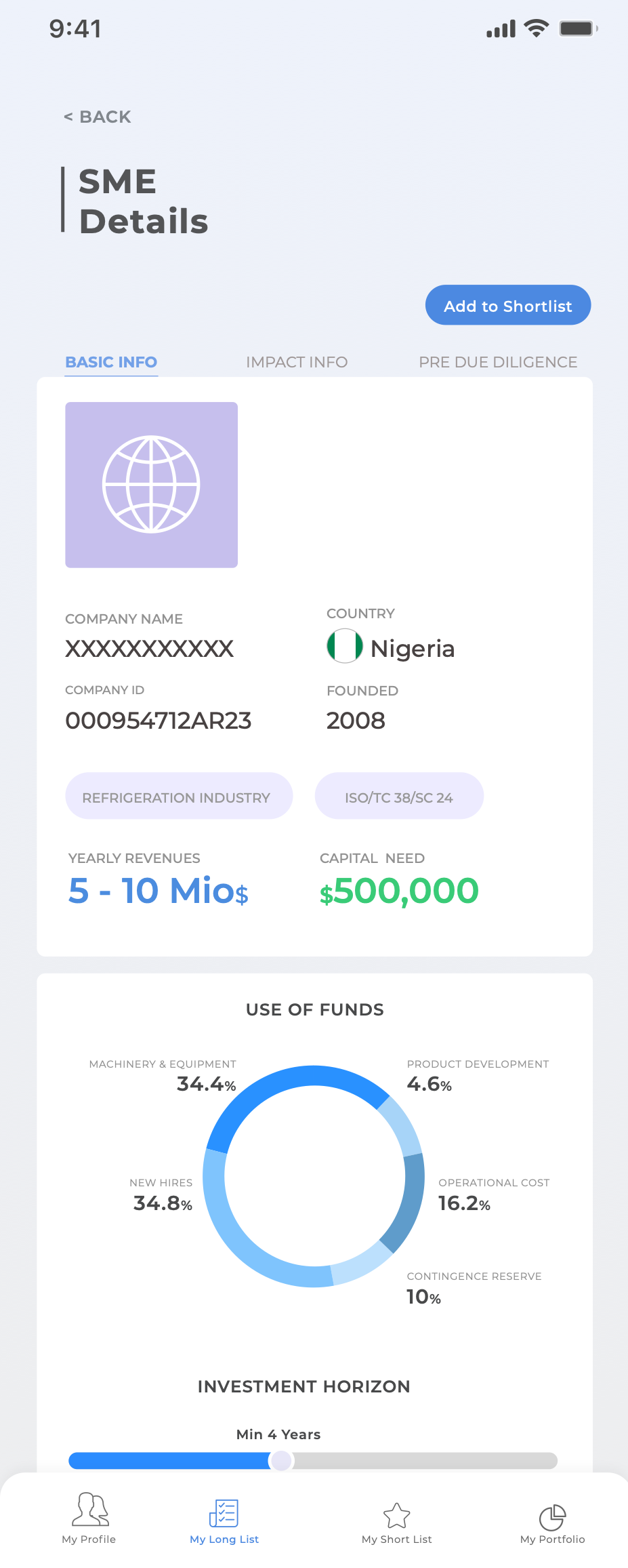

SME Details

The SME details reveal more important specificatons, for example not only the capital needs (here $ 500K) but also the capital appropriation, the so-called Use of Funds.

Whenever a SME meets the investor´s expectations, it can be added to a short list which you can compare with a „shopping basket“ of an e-commerce shop.

My Short List

The Short List consists of all SMEs which the investor is ready to invest in and where she needs more information for a so-called pre due diligence, a careful review of investability with regard to legal, commercial, technical, social, environmental and other SDG-aligned impact aspects.

It´s for the UNIDO to support the SMEs in providing the latter information.

Once the Short List is complete, the investor requests for the pre due diligence information, in particular she wants to prove the SMEs´ identity.

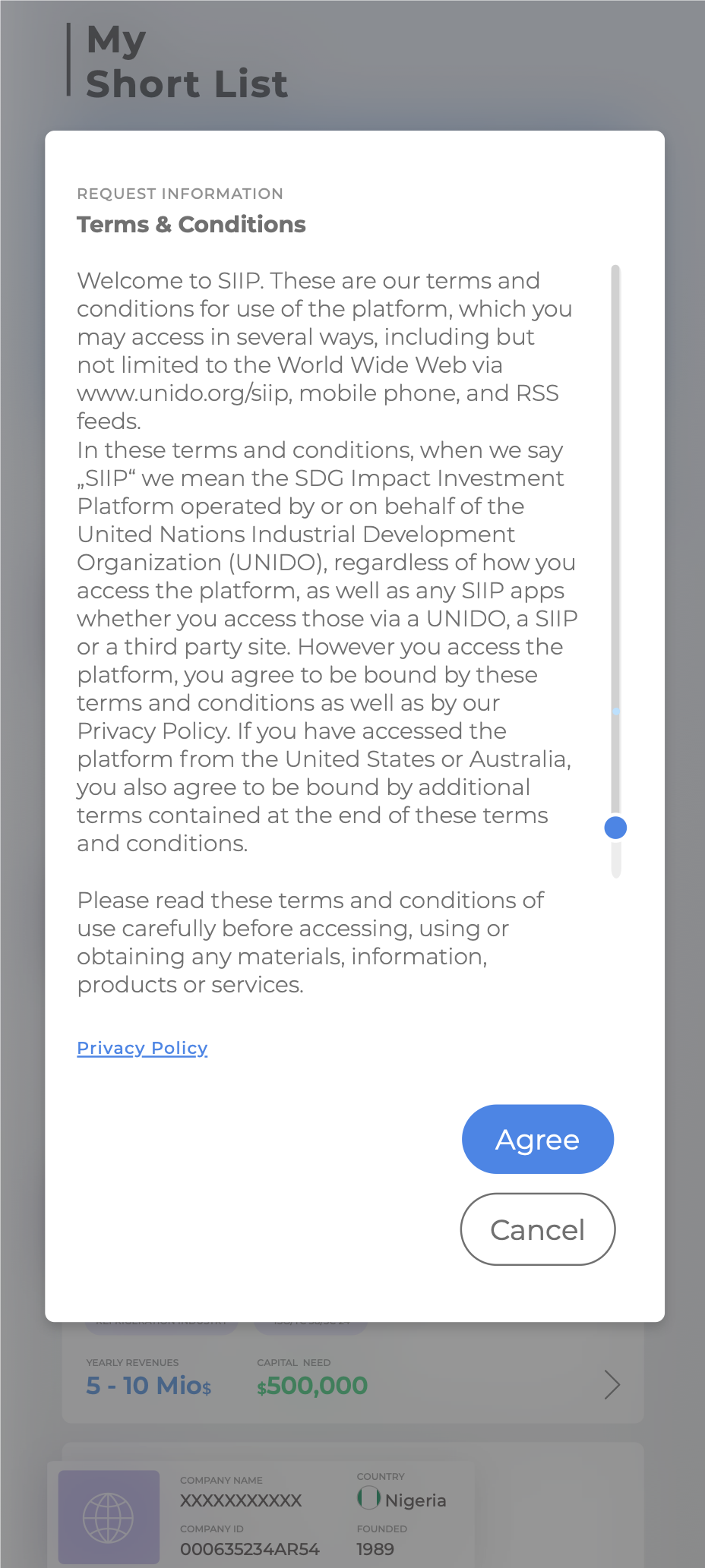

Terms and Conditions

All short-listed SMEs will automatically be informed by SIIP that there´s an interested investor who requested detailed information on them.

Therefore, after clicking the Request-Information-Button, the investor has to confirm SIIP´s Terms & Conditions (by a „double opt-in“ procedure). The same procedure the SMEs have to carry out.

This ensures that all participants of the platform (investors, SMEs, and SIIP itself) agree upon sharing information and executing transactions.

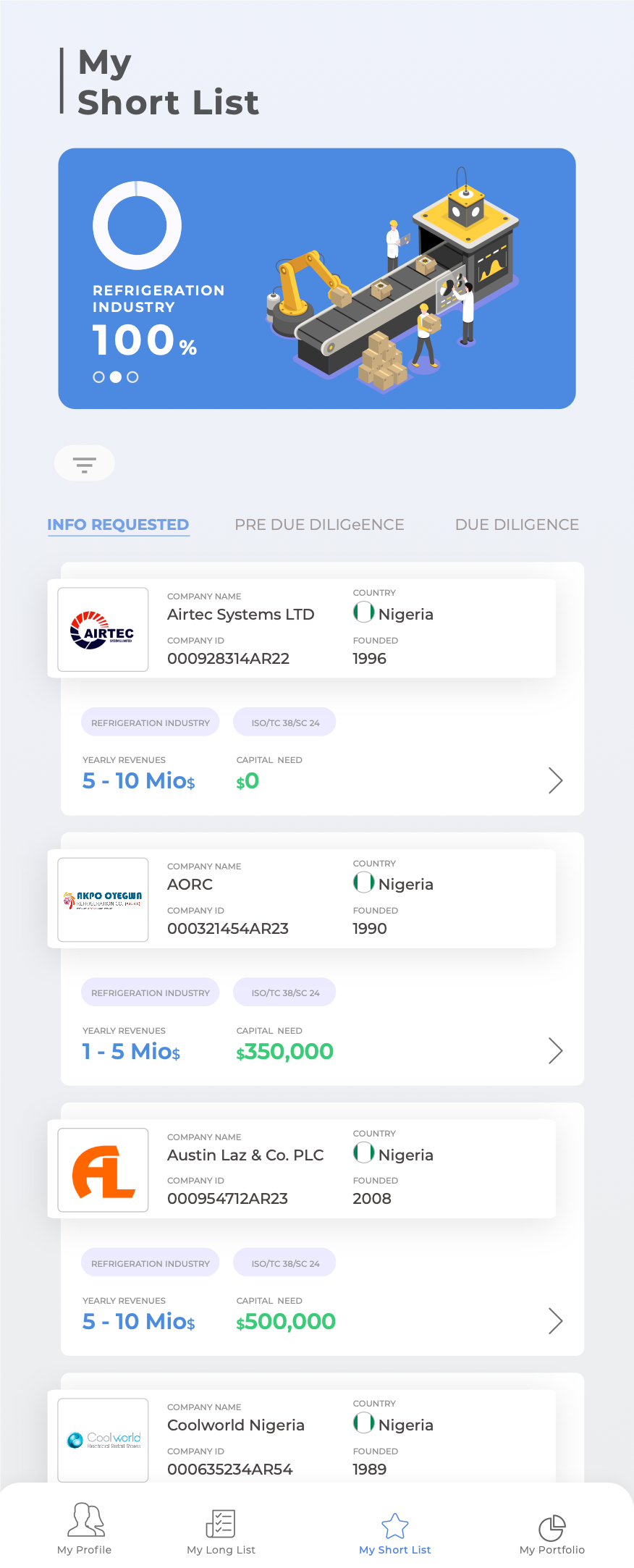

My Short List unvealed

All short-listed SMEs will automatically be informed by SIIP that there´s an interested investor who requested detailed information on them.

Therefore, after clicking the Request-Information-Button, the investor has to confirm SIIP´s Terms & Conditions (by a „double opt-in“ procedure). The same procedure the SMEs have to carry out.

This ensures that all participants of the platform (investors, SMEs, and SIIP itself) agree upon sharing information and executing transactions.

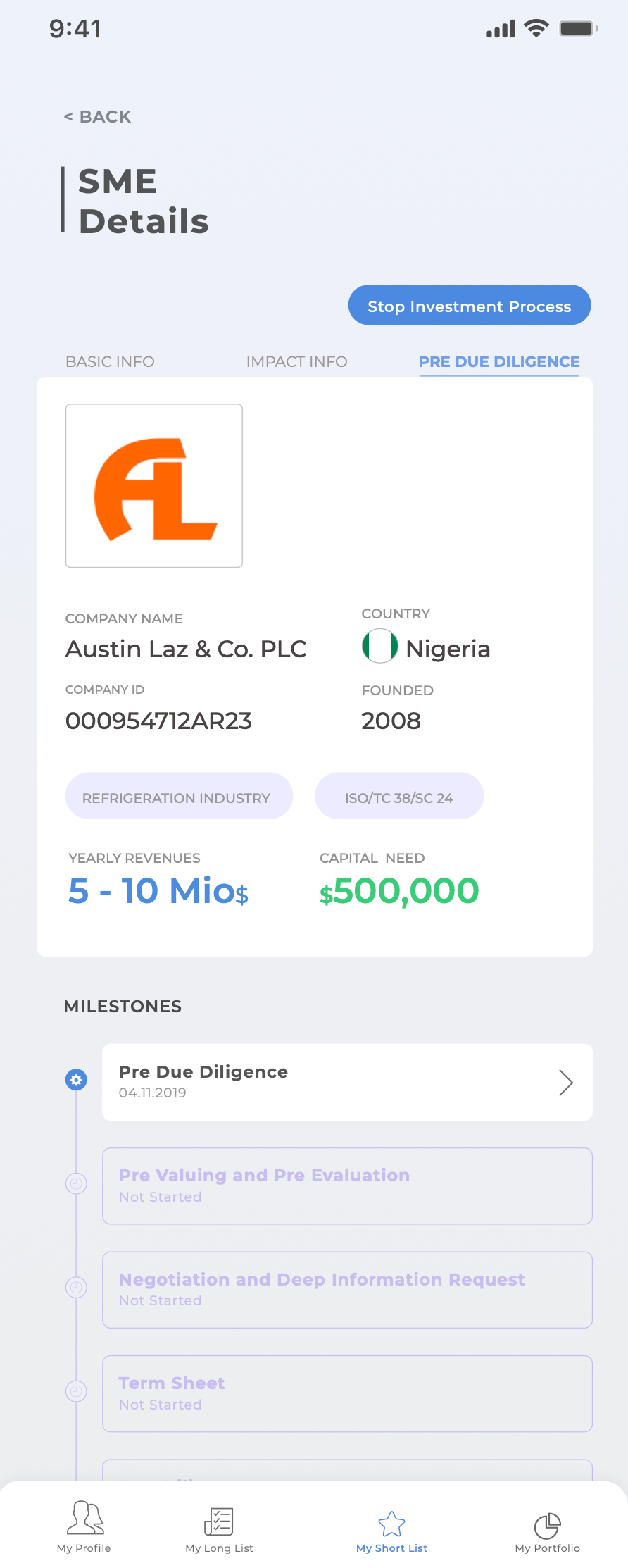

SME Details unvealed

Here´s the Basic Information of Austin Laz & Co. in detail.

In particular, the investor can follow the investment process with certain milestones after completing the single phases of this process. In this example, the SME is in the pre due diligence phase.

In addition to the basic information, SIIP offers a set of more details, for example concerning the impact information.

Again, it´s UNIDO´s task to establish a system how to formulate, measure, and achieve the SDG impact.

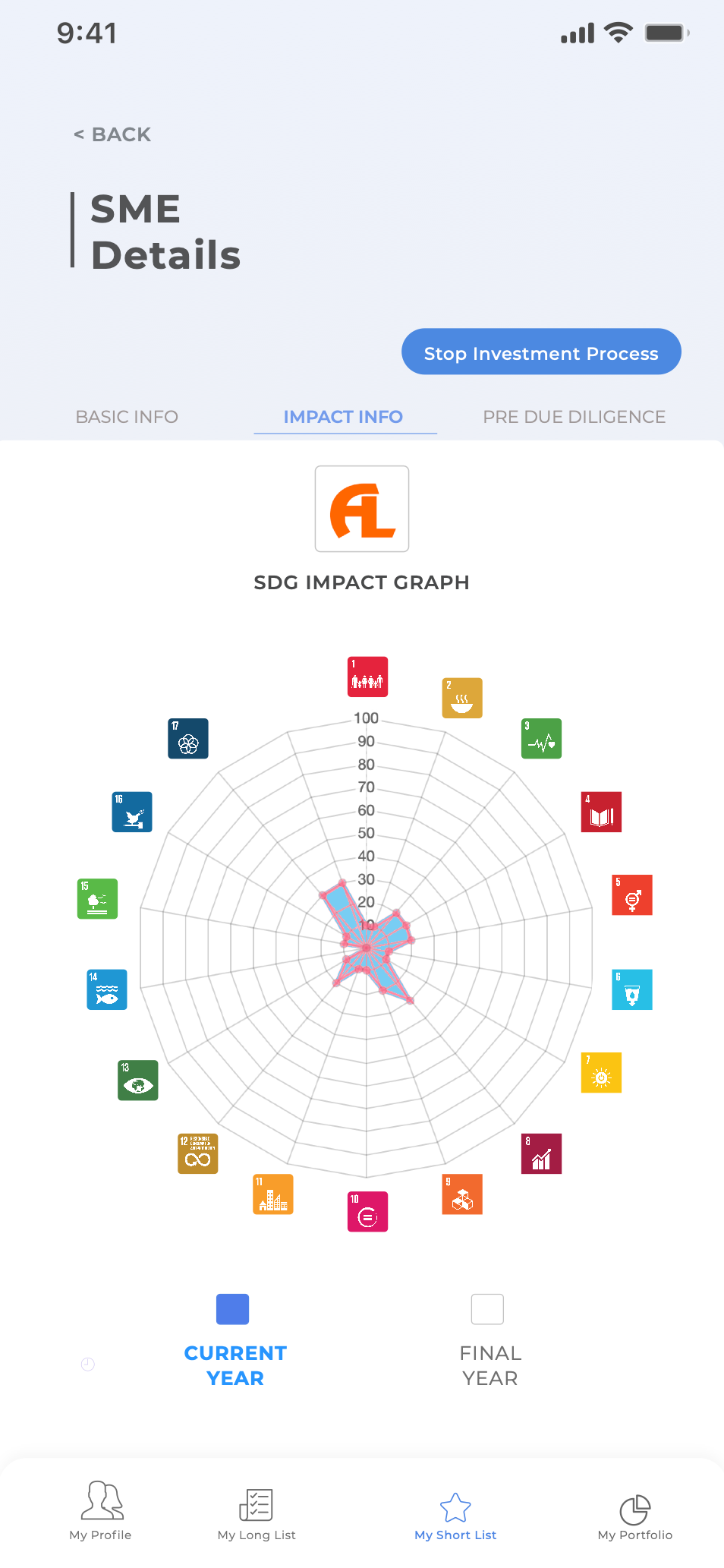

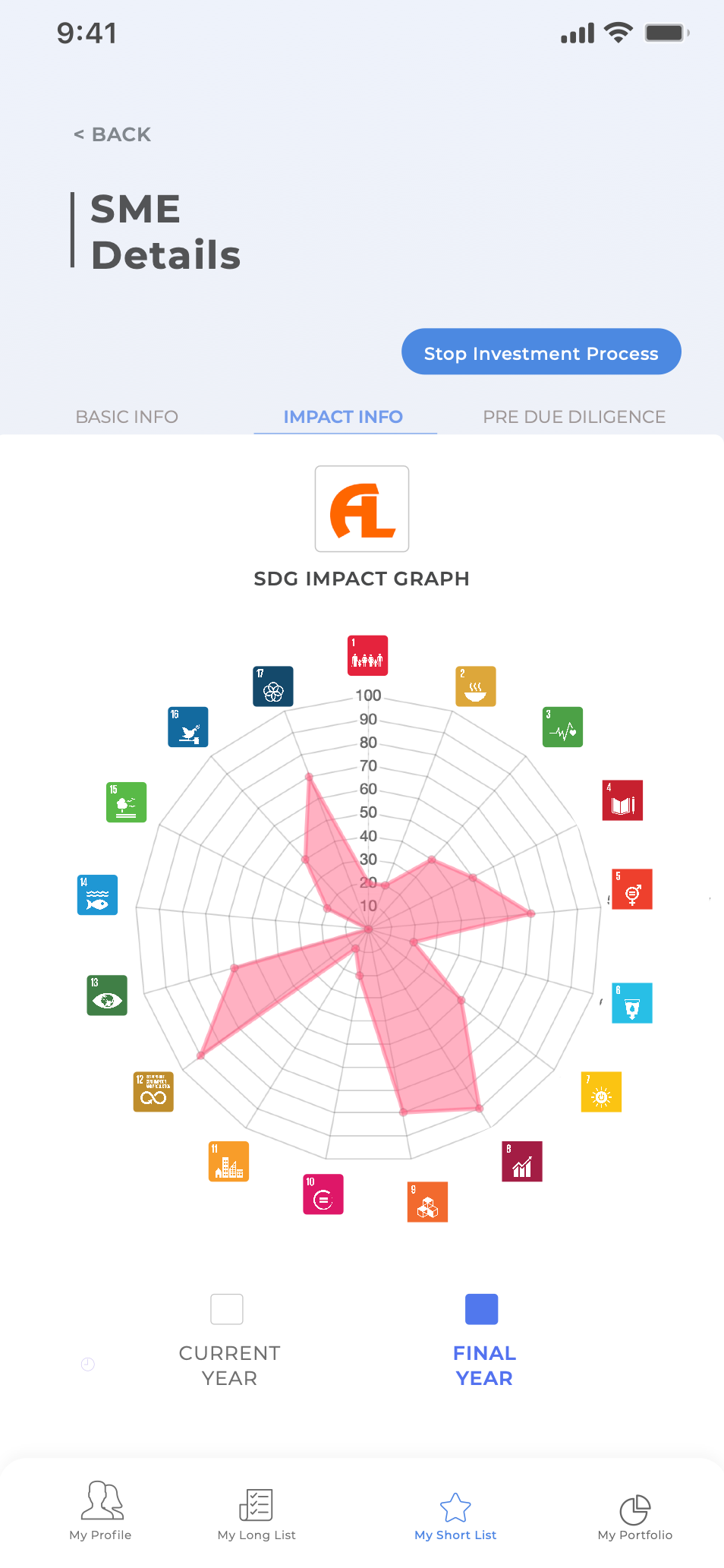

SDG Impact Graph

The SDG Impact Graph of the SME shows both for the current (funding) year and for the final year at the end of the investment period the status-quo and the planned level of SDG impact to be achieved by the investment.

Investors may choose the perspective - here from the view of the Circular Economy - as well as the level of detail (here top level but if you click on one of the SDG symbols you can dig deeper and deeper into the subject).

In our example Austin Laz & Co. plans much progress in several SDGs, in particular in SDG 5, 8, 9, and 12 which perfectly matches the investor´s expections.

It´s UNIDO´s responsibility to monitor and validate the process and to verify the real results.

The completeness of data needed for a pre due diligence depends on the SMEs themselves. As has already been said, the more information available, the higher the probability of funding.

But it´s usual that the SMEs will upload missing data only after one or several investors have taken an interest.

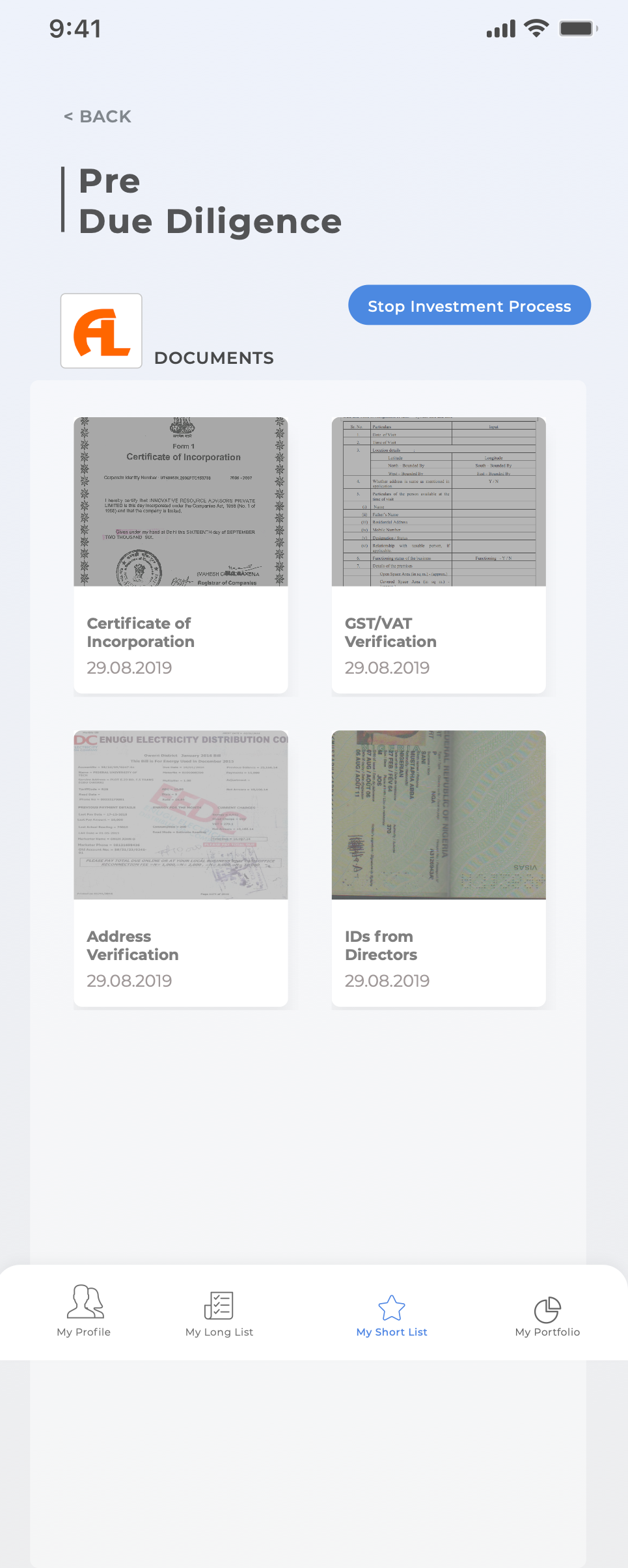

Pre Due Diligence

One of the most relevant issues is the identification of platform participants, and in the case of SMEs and its representatives, it can be done by uploading

- certificates of incorporation,

- tax or insurance assessment notices,

- phone or electricity bills, and

- ID cards.

It goes without saying that all this sensitive data are subject to the strictest data privacy and security regulations.

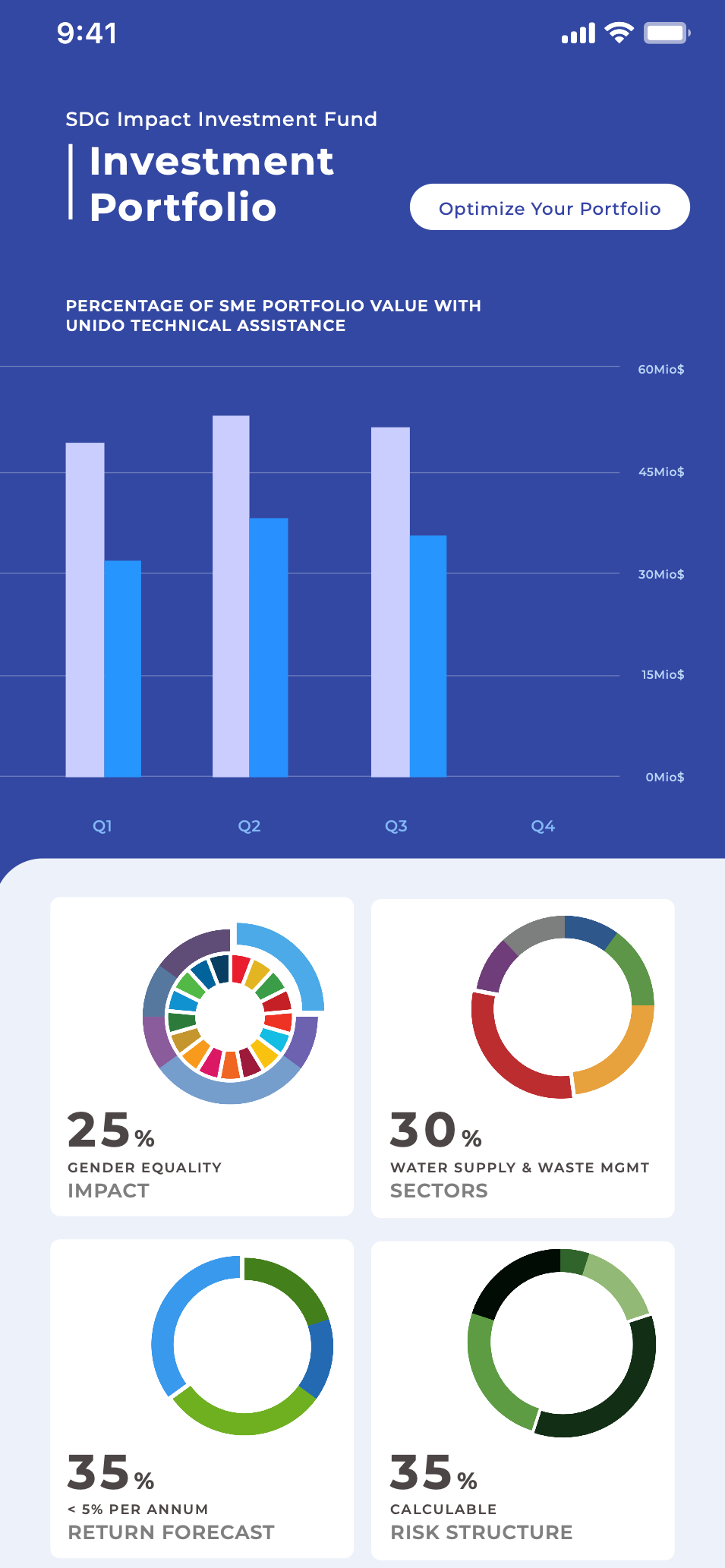

Investment Portfolio

After the investment has been completed, the Austin Laz & Co. in this example is now part of the Investment Portfolio of the SDG Impact Investment Fund.

The bar chart shows the performance of this investment portfolios measured by the value of SME investments (grey bars in the first 3 quarters of 2019) and the percentage of these SMEs supported by UNIDO´s Technical Assistance (blue bars).

Of course, many other evaluations are possible as in the pie charts shown.

SIIP is a technological and economical platform which connects SMEs and investors and enables impact investments aligned to the 17 SDGS.

But in future it will be much more.

The more investments are done, the more data we collect, the better we understand the requirements and needs of both investors and SDGs.

And the more we can automize these procedures by machine learning and other AI tools, the better the matching will be while making data, algorithms, and decisions transparent and cost-efficient through blockchain technology.

Thank you for your support!